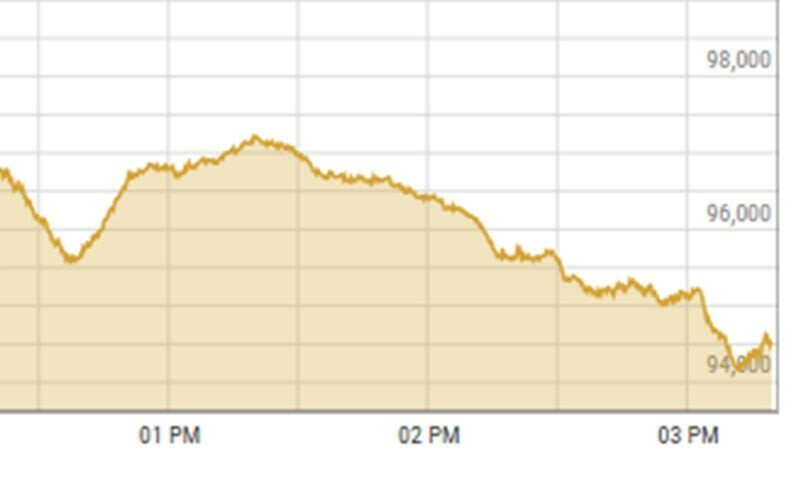

Following gains in early trading on Tuesday, shares at the Pakistan Stock Exchange (PSX) fell more than 3,200 points, which analysts ascribed to political unrest.

The KSE-100 benchmark had risen 1,431.29 points, or 1.46 percent, from its previous close of 98,079.78 points at 11:14am to 99,511.07 early in the day.

The index, however, fell 3,224.97 points at the end of the trading day, closing at 94,854.81 points below the previous close.

Topline Securities CEO Mohammed Sohail claimed that worries over an opposition PTI protest in Islamabad were the reason behind the market’s decline.

Due to PTI’s “do or die” demonstration in the federal capital, which has been under lockdown for the past three days and has experienced internet outages, the political situation in the nation is still tight. Using Rangers and other security forces in the city, the government has threatened to put an end to the PTI demonstration.

Politics is partly to blame for market volatility, according to Yousuf M. Farooq, director of research at Chase Securities.

In reference to the first bull run, he had noted that although the market was still “choppy on fears of the political situation turning violent,” the banking industry saw a surge after the State Bank of Pakistan (SBP) announced that it was eliminating the minimum deposit rate (MDR) for large depositors.

“In the event that banks do not offer competitive rates, we think a move like this will encourage large depositors to choose to buy T-Bills, PIBs, and Sukuks directly,” Farooq said.

As workers and supporters from all over the nation tried to resist arrests, baton charges, and tear gas in order to join the agitation, the convoys took a break after PTI leaders declared they were in “no hurry” to reach the federal capital. The PTI protest, which the government is determined to put down with force, was initially planned for November 24.

No Comment! Be the first one.